The solutions we have found to our various needs throughout history and adapting these solutions to changing conditions, have been one of the main factors for achieving success in every field. In this context, it is very important to ensure the continuity of the resources we use to meet our needs and to maintain the balance.

As sustainability is important in every field, it is also of vital importance for companies in economic and financial terms. Companies that set goals for their economic and financial sustainability within the scope of their vision and mission and take the right steps towards this goal will continue to grow and multiply their success by keeping up with the changing world standards.

As in every sector, one of the key elements of success in the banking sector is to achieve sustainability. In order to quickly grasp the opportunities that arise in crisis situations, to make the necessary moves in the most agile way possible, to keep the satisfaction of the customers at the highest level, to meet the expectations of the stakeholders and to fulfill the requirements of many other success criteria such as 'creating value', banks develop more than one innovative application under the name of sustainability studies.

This statement, which is under the heading of sustainability in Garanti Bank's 2019 Integrated Annual Report, “The green project finance loan and green corporate loan, which it started to offer in 2018, encourages the improvement of the sustainability performance of the companies that receive the loan throughout the term. Companies that receive loans in green loan agreements, both of which are the first in their field in Turkey, can gain advantages in loan interest or commission rates when they increase their performance in line with the criteria determined in the fields of environmental, social and corporate governance throughout the term. As of 2020, Garanti BBVA continues its support for green and environmentally friendly energy by making use of 100% renewable energy in all branches and buildings with suitable infrastructure.” emphasizes the importance of considering sustainability as a whole under many headings, rather than just targeting economic sustainability.

One of the most important principles of sustainable development is the task of banks in eliminating inequalities, and carrying out activities for the access of financial services. Having low-carbon economy in their sight, Garanti Bank provided all of the project finance loans specific to new energy generation investments to renewable energy projects in 2019. We can say that this has increased their financial inclusion by strengthening their environmental sustainability activities and responsible products and services portfolio.

Financial inclusion is the most important facilitator of economic growth, job creation and development. As it can be seen, banks that have improved themselves in the field of financial inclusion in line with their sustainability goals have achieved the same momentum in other areas, much easier and faster.

Employee satisfaction, which is one of the most important factors that brings success, is also included in the scope of sustainability activities. When we examine the pages devoted to the sustainability part of the current annual report prepared by İş bank, it is stated that “İş bank recruits employees who match its corporate values and supports all its employees throughout their careers. In this context, all managers are promoted through systematic, transparent and predictable career paths in line with criteria such as promotion exams, performance and tenure at İş bank, where no mid-level managers are recruited and all managers are trained from within. They can access the development opportunities they need during promotion processes and they can attend the training required by their managerial positions. Providing a safe and creative work environment that respects differences and contributes to professional and personal development, is among the bank's business priorities.”. Within the scope of these targets and criteria, İş bank, which has a 55% female employee rate, has proven that they have successfully overcame gender equality in employment. In addition, in order to ensure equal opportunity, they intensified their talent management activities to increase digital competencies and offered various trainings to employees.

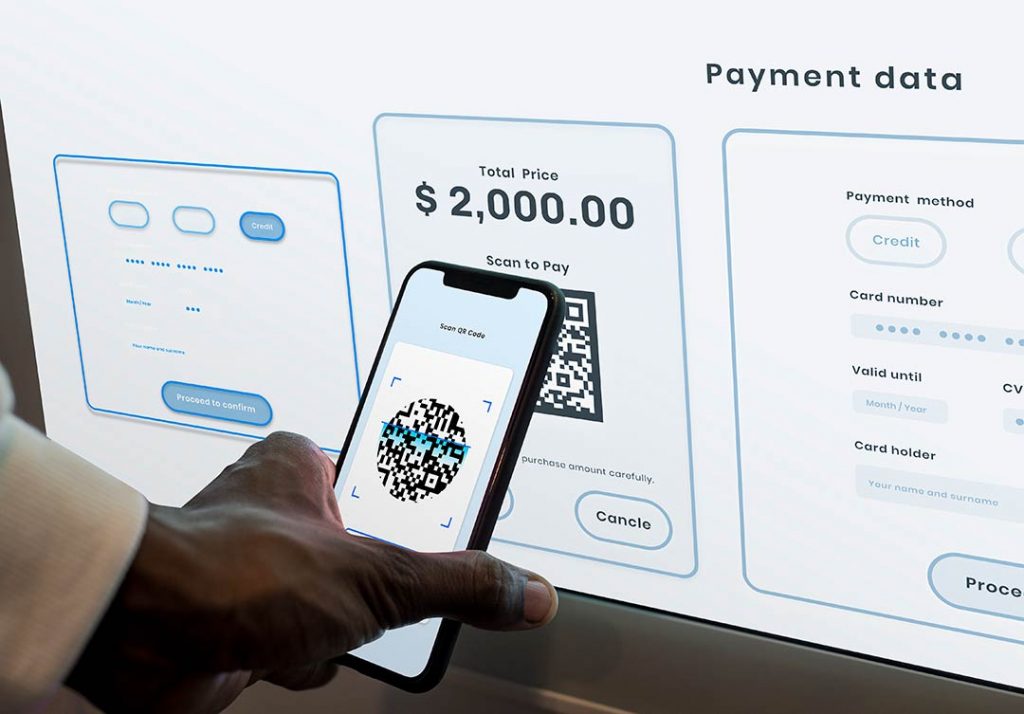

Standing out with its digital banking and data security efforts in terms of customer experience and satisfaction, İş bank aimed to offer personalized products and services to customers with digital products and services, and to ensure 24/7 accessibility without getting stuck with data security obstacles by executing this process over the internet. İş bank reached a total of 8.1 million digital banking customers and 7.8 million mobile banking customers in 2020, the year that Covid-19 had entered our lives. İş bank has achieved sustainability in this context with the steps that they have taken.

Banks must demand regular feedbacks by offering products and services that help customers make informed financial decisions and manage their financial situations in order to ensure sustainability by making agile maneuvers.

Achieving ethical sustainability is also important for a bank to take steps in accordance with ethical principles that are in line with its mission and vision. Maintaining the mutual trust between costumers and the bank is also important since trust is the reason for existence of financial organizations. When we examine TEB Bank's most up-to-date sustainability report, its attitudes against corruption and the measures they have taken are as follows: “Board of Directors; It has taken all necessary measures so that the Board of Inspectors can inspect all the activities and units of the Bank and its subsidiaries within the scope of consolidation without limitation. Between 01.01.2016 and 31.12.2017, a total of 210 Branch audits were carried out by the Board of Inspectors, 82 General Inspections, 26 Credit Portfolio Value Inspections, 61 Credit Portfolio Management Inspections, 16 Operations Special Inspections. and 25 Solo Operations Inspections. In this context, loan disbursement and collateral conditions, loan repayment performance, customer and guarantor morale, branch risk management effectiveness and governance, compliance of branch practices with legal and internal bank legislation, management of risks that may arise from operational transactions, and the effectiveness of the

functioning of the internal control system were evaluated.”. In addition, this required the completion of various trainings, foreseeing that not every employee on the subject may have the necessary equipment in order to act in accordance with ethical principles.

The economic problems we faced with the Covid-19 pandemic have proven once again how important sustainability is. Maintaining sustainability requires careful steps in an environment of uncertainty that suddenly takes control of our lives and restricts us, such as a pandemic. For this reason, the World Bank created the Sustainability Checklist to be a guide in the recovery process of countries. The 'corona bonds', which entered our lives with the Covid-19 pandemic and were created for the needs arising during the pandemic process, promise to bring innovative solutions to the situation we are in, as in other sustainable bond examples.

In conclusion, we can safely say that economics is not the only area in which a bank must achieve sustainability in order to be successful. As it can be seen, institutions that aim to create value in line with sustainability not only for their company but also for their country and the world that they live in, have always been at the forefront.

Share:

Related Articles

Why Do Managers Struggle with Genera ...

A reality long felt in the business world is this: there is a natural diffe ...

Leadership

Support, love, and trust received in childhood nurture self-confidence, cou ...

Generation Z: Not Just a Mirror, but ...

One of the most frequent complaints in today’s business world is: “Young em ...

A New Era in Business with Artificia ...

The Industrial Revolution began with steam. Then came electricity, computer ...

The New Face of Entrepreneurship: Wo ...

The new generation of entrepreneurship is no longer solely profit-driven; i ...

Understood Employees Contribute and ...

In the corporate world, we often hear statements like: “They’re talented, b ...

The Silent Power of Corporate Succes ...

In today's business world, organizations operate in an environment shaped b ...

Customer Relations and Training in B ...

Bancassurance, a business model in which banks market insurance products to ...

What Awaits the Business World? A St ...

Digitalization is no longer just a technological trend but a necessity for ...

Digital Transformation in Conflict M ...

Conflict is a reality we encounter in all aspects of life. Whether at home, ...

The Road to Success: Market Dynamics ...

In today’s rapidly changing market conditions, the importance of management ...

Leadership in the Digital Age: A New ...

Leadership in the digital age requires embracing continuous learning, innov ...

Mastering Risk Management

Mastering risk management is not merely an option for businesses but a nece ...

International Banking in Germany: A ...

Germany, with its strong industrial structure, high-technology products, an ...

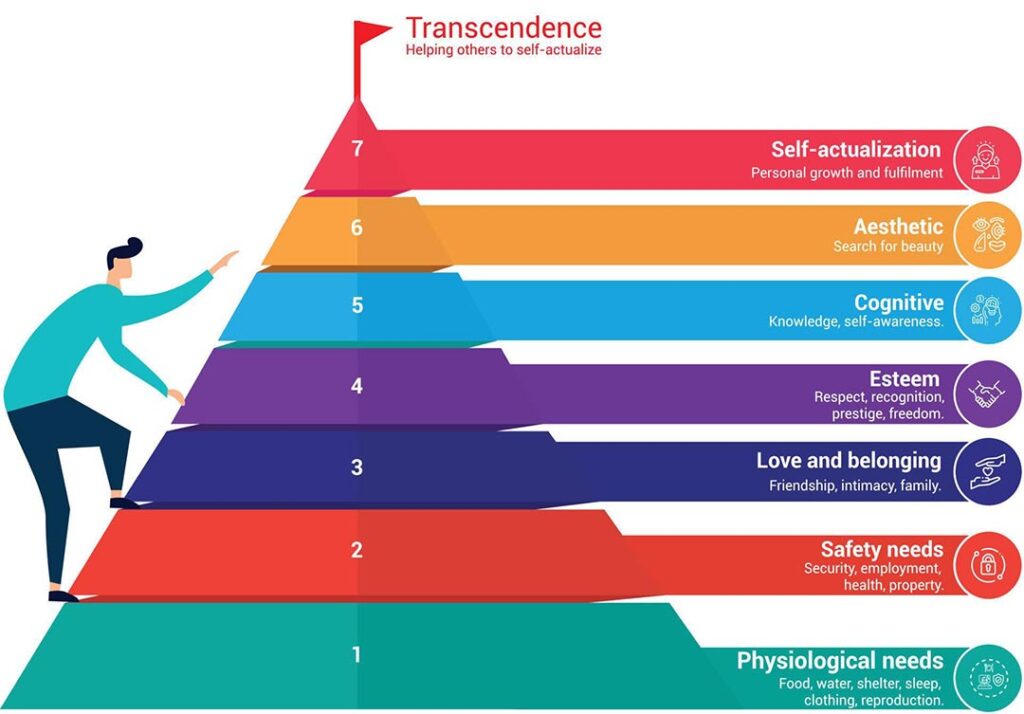

Leadership and Maslow's Hierarchy of ...

Abraham Maslow's hierarchy of needs is a fundamental psychological theory u ...

Leadership and Sustainability of Org ...

Today's business world is characterized by continuous change, technological ...

The Importance of Coaching Skills f ...

The Importance of Coaching Skills for LeadersCoaching skills are essenti ...

Fintech in Turkey: The Rise of Finan ...

Fintech in Turkey: The Rise of Financial Technology

Bancassurance

Bancassurance is a business model that is among the financial services offe ...

Banking and Frankfurt

When the banking and finance sector in Europe is analyzed, it is seen that ...

Digital Banking and Germany

Digital banking is a banking service where customers can do their banking o ...

Banking in Germany

Euro used since 2002 in The Eurozone, the currency of 19 EU members. There ...

Strategic Communication

Strategic communication plays a critical role in the success of an organiza ...

Importance of Supply Chain

The supply chain is a critical factor in which a company manages the flow o ...

Key to Success: Going Digital

Digital transformation is a transformation process that aims to increase th ...

Welfare

Poverty and inequality are one of the biggest challenges the current societ ...

ChatGPT

ChatGPT, developed by the OpenAI company known for its work and research in ...

What is Emotional Intelligence and w ...

Emotional intelligence (also known as emotional quotient or EQ) is the abil ...

The Importance of Women's Employment ...

Women's participation in the workforce is closely related to the level of d ...

Digital Banking II – Digital Banking ...

A serious step taken for the spread of “digital banking” in Turkey, providi ...

The Perception of Morality within Ma ...

If everybody in the world jumped out of a window, would you? This question ...

Digital Banking

Digital banking is a banking technology that offers customers the opportuni ...

Banking, Artificial Intelligence and ...

We have heard the concepts of metaverse, artificial intelligence and machin ...

Green Asset Ratio

Sustainable finance has an important place among the investments made for t ...

Servant Leadership

There is an effective form of management that we often hear about today: se ...

Sustainability In The Global Banking ...

Before Covid-19 wreaked havoc on the world’s economies, the global banking ...

Revolution of Digital Banking

With the European Central Bank considering to investigate for a digital cur ...

Taking Action and Making Decisions i ...

Uncertainty is the fact that an event is not within the framework of certai ...

Wind of Change

Change is an important concept that must be managed for employees at all le ...

Organizational Justice

“What is justice? Giving water to trees. What is injustice? To give water t ...

Open Banking

Digital transformation has started to show its effects in every aspect of o ...

Digital Literacy And Corporate Life

There are many innovations that managers and employees need to follow in or ...

Financial Literacy

The words money and economy are two important concepts that have a great pl ...

Sustainability and Bank

The solutions we have found to our various needs throughout history and ada ...

Adaptability, Flexibility and Leader ...

Being able to adapt to changing conditions is very, very important not only ...

Creativity and Leadership Relationsh ...

The world is getting more competitive every day. For this reason, the servi ...

Competitive Analysis and Banking Sec ...

Competition analysis requires you to examine your direct and indirect compe ...

Delegation in Management

The statements "two heads are better than one" or "teamwork makes the dream ...

Climate Change

All creatures evolve to best adapt to environmental impacts. Those who are ...

Change of Banking Service Channels i ...

Global crises such as the pandemic, force the existing structures to change ...

Innovation

It is undeniable that innovation has a very important place in today's worl ...

Artificial Intelligence

Artificial intelligence is no longer just something specific to science fic ...

Entrepreneurship

Entrepreneurship is the process of starting a new business that incorporate ...

Global Leadership

The world is changing day by day and the information we have today is out o ...

Resilience and Leadership

We encounter many events in life that cause us difficulties and stress. How ...

Entrepreneurial Spirit for Leaders

Why is important for success? The conventional perception of entrepreneursh ...

Finance Leadership in a Pandemic

Crises bring along a period in which institutions need to review their fina ...

Crisis Management

Crisis is a state of tension that puts the existence and goals of an organi ...

Strategic Leadership and Pandemic

Strategic Leader is the person who sets the roadmap to achieve the ultimate ...

Awareness, Appreciation, Success

It is very important for a person to recognize himself, discover his power ...

Woman and Career

People who are raised by unemployed mothers have a mother model in their mi ...

Conflict Management

In the broadest sense, conflict is disagreement between two or more people ...

Leading with Kindness

Kindness is an important virtue. Kindness in all areas of life makes relati ...

Smart Meetings

Meeting management is the process of managing all stages and components of ...

Negotiation Management

Negotiation is defined as a dialogue aimed at reaching a common and benefic ...

Virtual Leadership

The repercussions of the digitalization process in business life were sprea ...

Manager and Patience

Patience is an important concept in management. Patience is active, not pas ...

Being All Ears

Human beings differ from other creatures in their way of communicating. Com ...

Networking

The fact that managers in the corporate world act with awareness of network ...

Asking Strong Questions

For managers, asking a strong question is an important skill. Managers, who ...

Managing Yourself

The manager at work is in communication with the other parts of the busines ...

Mental Immunity

In the fight against Coronavirus (Covid-19) pandemic, knowledge and awarene ...