Digital transformation has started to show its effects in every aspect of our lives. It even helped new business models to emerge. Integrating traditional methods into technological environments with the help of digital transformation saves us from many painful processes.

Technology provides both us as individuals and organizations with great opportunities in order to get the highest efficiency from the services we use. With the digitalization movements in the banking world, great steps have been taken to put the services offered to customers into practice in the most efficient way and to provide mutual benefit between the organization and the customer. The concept of FinTech (Financial Technology), which entered our lives a few years ago and whose name we have begun to hear often, is exactly what this is talking about. To put it briefly, Fintech is the financial industry where financial services are developed by utilizing technology.

The developments in the field of fintech have deeply affected the functioning of many processes, allowing us to meet new concepts and business models in the finance sector. Open Banking is one of them. Open Banking is the sharing of customer data with third party providers with the consent of the customers.

Open banking is the provision of personalized service by using data generated within the framework of each transaction performed on the customer's account such as expenditures, credit usage information, paid invoices, the customer's budget, the product, service or services that the customer spends the most. It is aimed to provide mutual benefit to customers, banks and third party providers. Thanks to open banking, customers find the opportunity to easily access the most suitable choice for them by comparing various financial services and products. In addition, individuals with accounts in more than one bank can access all their financial information through a single application instead of using different interfaces for each bank. This ease of access provided to the customer makes transactions much faster and easier, allowing to keep customer satisfaction at the highest level.

When banks compare the customer data they collect with the data collected from other institutions, they encounter a more realistic picture of the customer's choices, and thus they have the opportunity to better meet customer expectations At the same time, the bridge established between third party providers and banks has provided a very important environment for the development of services and products tailored to the customer.

Banks, which have succeeded in creating the necessary infrastructure and interface by keeping up with the digital transformation, have become an important pillar of this great and innovative change in the financial world. Thanks to the innovations that come with open banking applications, customers have been introduced to many new transactions in addition to conventional banking transactions such as money withdrawal, deposit and loan transactionsOffering more personalized services and products to customers with open banking activities increases customer satisfaction and strengthens the bank-customer relationship; At the same time, innovative services and experiences offered to customers with open banking ensure that the relationship is kept dynamic. With the development of the financial services market in this way, the customer is provided with ease of access to a large extent.

APIs (Application Programming Interface) developed by banks for this application are codes and protocols that enable different platforms to communicate with each otherAPIs, which are the cornerstone of the relationship between banks and third-party providers, are interfaces with which different software can interact with each other and have greatly facilitated and improved open banking applications. Due to the data collected in an interface with APIs, the competitive environment between banks paves the way for better performance and more innovative solution proposals.

The first state to switch to the open banking model was the United Kingdom, when nine banks came together under the name of 'Open Banking Implementation Entity (OBIE)' in 2016. According to OBIE's data, 118 institutions have obtained Open Banking licenses after 15 months. In addition to the nine big banks, known as CMA9, which are mandated to participate in the system, 40 banks have been included in OBIE by complying with these standards.

The following statement that is in the annual report published by OBIE for 2020 shows that small businesses also get positive results from the open banking model: “OBIE undertook the SME Financial Landscape research to measure the impact of open banking solutions on the small business community. The research, published in December, highlighted that an increasing proportion of SMEs (around 50% of those surveyed) reported adopting open banking solutions during the pandemic..”. In the same report, as we enter 2021, more than 3 million people and businesses in the UK are using open banking. This proves the potential that open banking holds for the innovative solutions for future applications that are yet to come

While the COVID-19 epidemic, which affected our lives in December 2019, caused great damage to the economy of almost every country in the world, it is foreseen to provide solutions suitable for the financial needs of individuals thanks to the ease of access to financial resources brought by open banking and the collected data. In the UK, it is planned to assist 5 million self-employed people affected by the COVID-19 crisis in light of open banking practices.

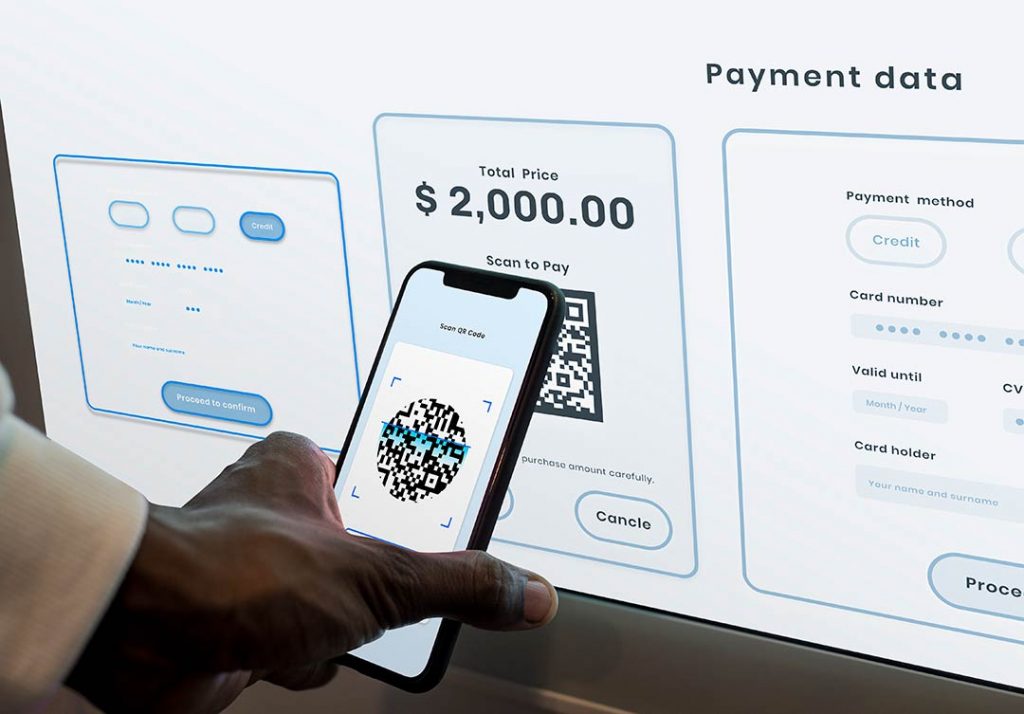

Thanks to open banking, all of our financial data has been moved to a compact application on our phone from the pages of thick black-lined notebooks where financial data were kept in the past. All of our expenses, statements, bill payments, loan payments and many other financial data that need to be stored are now available in one place and can be processed without any effort.

Open banking practices in Turkey have been subject to certain regulations in the Eleventh Development Plan published in July 2019, with the decision “Legislation will be aligned with EU Payment Services Directive 2 in order to strengthen the open banking legal infrastructure”. “The Regulation on Information Systems and Electronic Banking Services of Banks', which defines the concept of open banking, entered into force on July 1, 2020, and open banking took its place in Turkish legislation for the first time. This regulation, which defines open banking, did not clearly delineate the boundaries of the practice, and authorized the Banking Regulation and Supervision Agency for future regulations on this subject.

The banks in our country are still in the process of harmonization and the transition to open banking application continues at the regulation stage. Having opened its API portal in 2016, Akbank collaborated with many business partners over this software, and this development became an important milestone in our transition period. Turkey's first and only open banking application, TekCep, offered by İşbank, has enabled customers to view all their financial data via İşCep. According to the data in the integrated report published by İşbank in 2020, TekCep serves 1500 customers.

Since the boundaries of the technical standards and application procedures of open banking applications in our country are not clearly defined, concrete examples are limited. However, it is possible to say that we have started to see ahead in this regard with the definition of the said regulation into the legislation. We can say that in the light of the regulations to be made by the BRSA, more concrete and accelerated applications are expected in the near future.

To summarize briefly, the tracking of financial transactions has become tremendously easier with open banking applications. Customers who carry out their transactions through a single platform can benefit from many services by sharing their data with banks and third party providers as a result of the transactions they perform. In the light of the collected data, financial services tailored to the customer profile create mutual satisfaction between banks and customers. Fintechs, while acting as a bridge between banks and third party providers, have the opportunity to improve their services and products by blending financial data and other customer data. At the same time, the competitive environment created by collecting all bank data in a single environment enables better services to be developed. It is an undeniable fact that open banking benefits all parties. However, since the foundation of every financial institution is based on mutual trust, institutions that implement open banking also need to provide a strict follow-up by making various regulations in order to maintain this dynamic.

In the light of all the benefits and innovations brought by open banking, we can say that this service model has come a long way in the financial world. Because, moving away from traditional methods and opening the doors of a technology based business model contains key clues about the future of banking.

Share:

Related Articles

What Awaits the Business World? A St ...

Digitalization is no longer just a technological trend but a necessity for ...

Digital Transformation in Conflict M ...

Conflict is a reality we encounter in all aspects of life. Whether at home, ...

The Road to Success: Market Dynamics ...

In today’s rapidly changing market conditions, the importance of management ...

Leadership in the Digital Age: A New ...

Leadership in the digital age requires embracing continuous learning, innov ...

Mastering Risk Management

Mastering risk management is not merely an option for businesses but a nece ...

International Banking in Germany: A ...

Germany, with its strong industrial structure, high-technology products, an ...

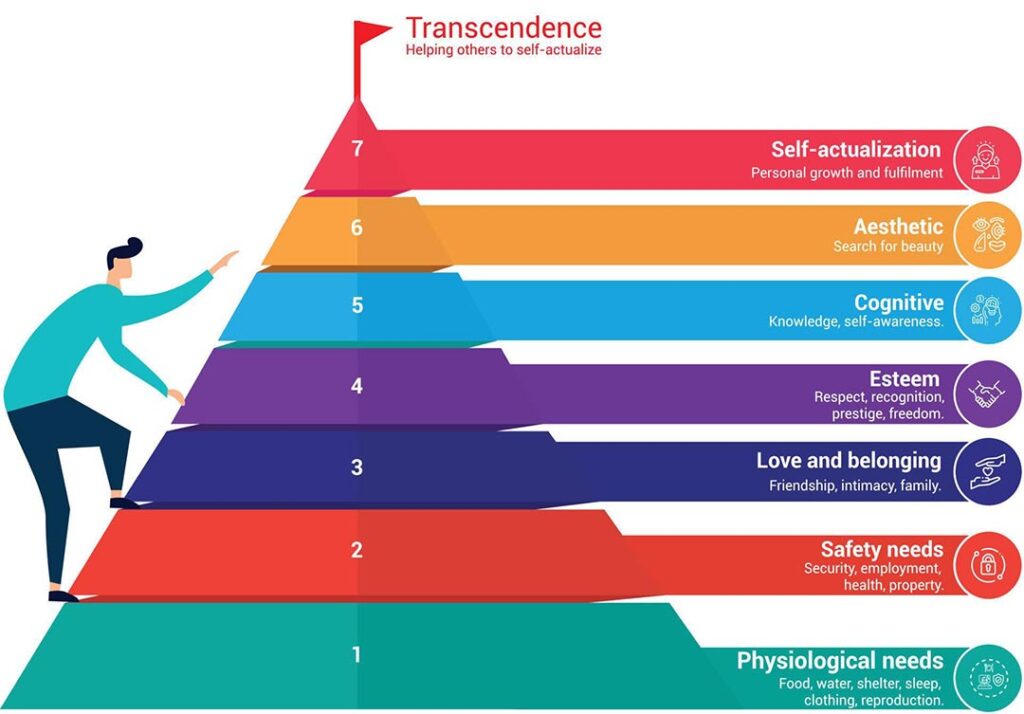

Leadership and Maslow's Hierarchy of ...

Abraham Maslow's hierarchy of needs is a fundamental psychological theory u ...

Leadership and Sustainability of Org ...

Today's business world is characterized by continuous change, technological ...

The Importance of Coaching Skills f ...

The Importance of Coaching Skills for LeadersCoaching skills are essenti ...

Fintech in Turkey: The Rise of Finan ...

Fintech in Turkey: The Rise of Financial Technology

Bancassurance

Bancassurance is a business model that is among the financial services offe ...

Banking and Frankfurt

When the banking and finance sector in Europe is analyzed, it is seen that ...

Digital Banking and Germany

Digital banking is a banking service where customers can do their banking o ...

Banking in Germany

Euro used since 2002 in The Eurozone, the currency of 19 EU members. There ...

Strategic Communication

Strategic communication plays a critical role in the success of an organiza ...

Importance of Supply Chain

The supply chain is a critical factor in which a company manages the flow o ...

Key to Success: Going Digital

Digital transformation is a transformation process that aims to increase th ...

Welfare

Poverty and inequality are one of the biggest challenges the current societ ...

ChatGPT

ChatGPT, developed by the OpenAI company known for its work and research in ...

What is Emotional Intelligence and w ...

Emotional intelligence (also known as emotional quotient or EQ) is the abil ...

The Importance of Women's Employment ...

Women's participation in the workforce is closely related to the level of d ...

Digital Banking II – Digital Banking ...

A serious step taken for the spread of “digital banking” in Turkey, providi ...

The Perception of Morality within Ma ...

If everybody in the world jumped out of a window, would you? This question ...

Digital Banking

Digital banking is a banking technology that offers customers the opportuni ...

Banking, Artificial Intelligence and ...

We have heard the concepts of metaverse, artificial intelligence and machin ...

Green Asset Ratio

Sustainable finance has an important place among the investments made for t ...

Servant Leadership

There is an effective form of management that we often hear about today: se ...

Sustainability In The Global Banking ...

Before Covid-19 wreaked havoc on the world’s economies, the global banking ...

Revolution of Digital Banking

With the European Central Bank considering to investigate for a digital cur ...

Taking Action and Making Decisions i ...

Uncertainty is the fact that an event is not within the framework of certai ...

Wind of Change

Change is an important concept that must be managed for employees at all le ...

Organizational Justice

“What is justice? Giving water to trees. What is injustice? To give water t ...

Open Banking

Digital transformation has started to show its effects in every aspect of o ...

Digital Literacy And Corporate Life

There are many innovations that managers and employees need to follow in or ...

Financial Literacy

The words money and economy are two important concepts that have a great pl ...

Sustainability and Bank

The solutions we have found to our various needs throughout history and ada ...

Adaptability, Flexibility and Leader ...

Being able to adapt to changing conditions is very, very important not only ...

Creativity and Leadership Relationsh ...

The world is getting more competitive every day. For this reason, the servi ...

Competitive Analysis and Banking Sec ...

Competition analysis requires you to examine your direct and indirect compe ...

Delegation in Management

The statements "two heads are better than one" or "teamwork makes the dream ...

Climate Change

All creatures evolve to best adapt to environmental impacts. Those who are ...

Change of Banking Service Channels i ...

Global crises such as the pandemic, force the existing structures to change ...

Innovation

It is undeniable that innovation has a very important place in today's worl ...

Artificial Intelligence

Artificial intelligence is no longer just something specific to science fic ...

Entrepreneurship

Entrepreneurship is the process of starting a new business that incorporate ...

Global Leadership

The world is changing day by day and the information we have today is out o ...

Resilience and Leadership

We encounter many events in life that cause us difficulties and stress. How ...

Entrepreneurial Spirit for Leaders

Why is important for success? The conventional perception of entrepreneursh ...

Finance Leadership in a Pandemic

Crises bring along a period in which institutions need to review their fina ...

Crisis Management

Crisis is a state of tension that puts the existence and goals of an organi ...

Strategic Leadership and Pandemic

Strategic Leader is the person who sets the roadmap to achieve the ultimate ...

Awareness, Appreciation, Success

It is very important for a person to recognize himself, discover his power ...

Woman and Career

People who are raised by unemployed mothers have a mother model in their mi ...

Conflict Management

In the broadest sense, conflict is disagreement between two or more people ...

Leading with Kindness

Kindness is an important virtue. Kindness in all areas of life makes relati ...

Smart Meetings

Meeting management is the process of managing all stages and components of ...

Negotiation Management

Negotiation is defined as a dialogue aimed at reaching a common and benefic ...

Virtual Leadership

The repercussions of the digitalization process in business life were sprea ...

Manager and Patience

Patience is an important concept in management. Patience is active, not pas ...

Being All Ears

Human beings differ from other creatures in their way of communicating. Com ...

Networking

The fact that managers in the corporate world act with awareness of network ...

Asking Strong Questions

For managers, asking a strong question is an important skill. Managers, who ...

Managing Yourself

The manager at work is in communication with the other parts of the busines ...

Mental Immunity

In the fight against Coronavirus (Covid-19) pandemic, knowledge and awarene ...