Digital banking is a banking service where customers can do their banking online without going to traditional bank branches. This service has quickly become popular in recent years because it has many advantages.

First, digital banking services allow customers to perform banking transactions faster and easier. Customers can save time and effort by banking through mobile applications or websites. Second, digital banking services allow customers to track their financial transactions and monitor their account activity. Customers can instantly view their account balances and recent transactions.

Third, digital banking services often cost less than traditional banks. Because digital banks have lower operating costs, which allows them to offer more affordable services to customers. In terms of technical data, digital banking services use innovative technologies such as big data analytics, artificial intelligence and cloud computing technologies. These technologies are used to make customers' financial transactions more secure and to ensure the security of customer data.

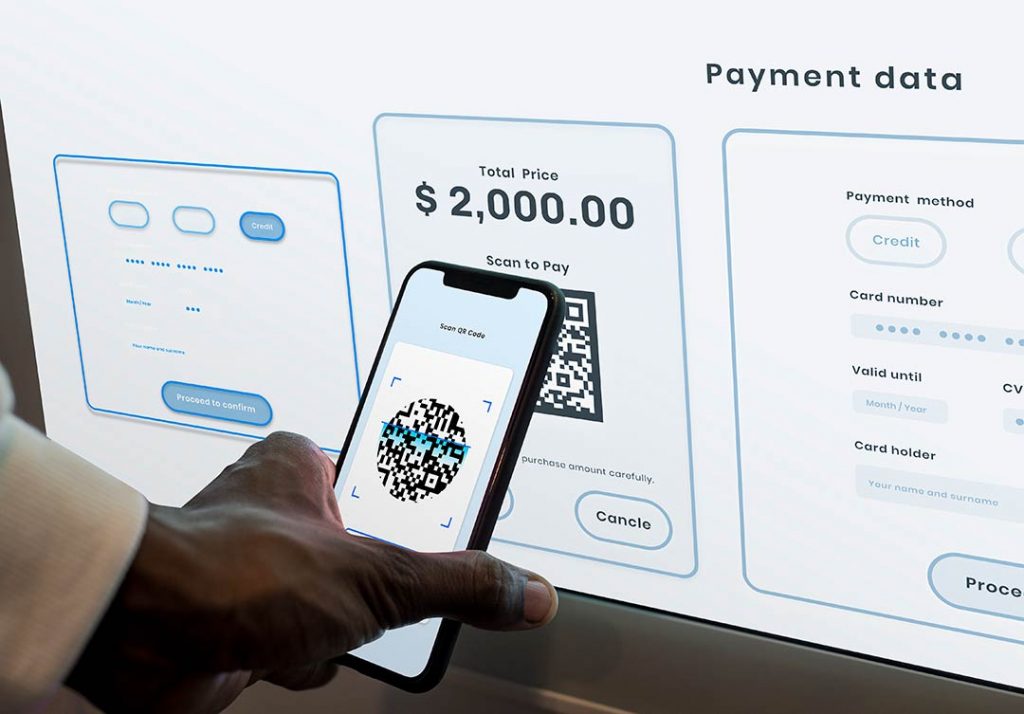

In addition, digital banking services include mobile devices, smart cards and NFC ( Near field It can be integrated with technological devices such as Communication ) technology . This makes banking transactions easier and faster for customers.

Banks that have obtained a digital banking license in Germany include:

1. SolarisBank: Berlin-based SolarisBank started its activities in 2016. The bank provides API access to financial services and serves other fintech companies.

2. O2 Banking: O2 Banking, a subsidiary of the German telecommunication company Telefónica, started its operations in 2017. The bank provides digital banking services to its customers in Germany.

3. Penta: Founded in 2016 , Penta is a bank that provides digital banking services for small and medium-sized businesses. Currently serving in Germany.

4. Kontist : Kontist is another bank that offers digital banking services and operates in Germany. The company provides financial services specifically for self-employed and small businesses.

Besides these banks, many traditional banks also offer digital banking services.

Some digital banks operating in Germany are:

1. N26: Founded in 2013, N26 is one of the largest digital banks in Germany. Providing mobile banking services to its customers, N26 serves more than 7 million users in Europe.

2. Deutsche Bank Mobile: Deutsche Bank launched Deutsche Bank Mobile , a digital bank offering mobile banking services, in 2016 . Through this application, customers can access their bank accounts and credit cards, make money transfers and perform other banking transactions.

3. Comdirect: Founded in 1994, Comdirect is one of Germany's oldest digital banks. Comdirect , which provides online banking and investment services to its customers, operates with more than 2.5 million customers.

4. Fidor Bank: Fidor Bank is a digital bank established in 2009. Offering its customers online banking, payment systems and other financial services, Fidor Bank operates in Germany, the UK, France and South Africa.

5. ING- DiBa: Although ING- DiBa is a bank established in 1965, it has also invested in digital banking services in recent years. Providing mobile banking, online account opening and other financial services to its customers, ING- DiBa serves more than 9 million customers.

Commerzbank and Deutsche Bank , which are now among Germany's largest banks, also operate in the digital banking space. However, the market share of digital banks in Germany is still small. For example, the total number of customers of large digital banks such as N26 is far below the number of customers of all banks operating in Germany. According to a report published by Deutsche Bank in 2020, the market share of digital banks in Germany is 6.5%.

With the rapid growth of the digital banking sector in Germany, traditional banks are also investing in digital banking services. In 2020, digital banking services of traditional banks operating in Germany such as Commerzbank and Deutsche Bank accounted for more than 20% of their total revenues. The number of companies offering digital banking services in Germany has been increasing rapidly in recent years.

Fintech stands for financial technology and there are also many Fintech companies in Germany. Fintech companies often offer many different financial products and services. As of 2020, it is estimated that there are more than 1,500 Fintech companies in Germany. Examples of Fintech companies operating in Germany are companies such as N26, Fidor Bank, SolarisBank and Auxmoney.

Many Fintech companies also offer digital banking services. For example, Solarisbank is a Fintech company that provides infrastructure services to financial institutions, and it also offers digital banking services. Other Fintech companies offering digital banking services in Germany include N26, Fidor Bank, Monzo and Revolut.

Deutsche Bank has a wide range of services in digital banking. The Financial Planner application, which stores and automatically analyzes the financial data of customers, provides customers with simple graphs about their income and expenses. E- safe application, on the other hand, is a digital application where customers can safely store account statements, documents related to securities, bank or non-bank contracts, identity information, passwords and personal documents. With this application, Deutsche Bank aims to reduce paper usage by encouraging the digital storage of documents. According to statistics published on the bank's website, Germany's annual paper consumption is equivalent to the distance between the earth and the moon and 1,000 trees. The InfoServices application, on the other hand, offers a personalized notification service to notify customers. This free service allows customers to receive notifications about expected payments. The SmartÜberweisung application, on the other hand, allows customers to easily transfer invoices or receipts sent in pdf format to the system.

The demand for digital banking services in Germany is increasing every year. According to a study conducted in Germany, the demand for digital banking services has increased rapidly in the last few years and the number of users of digital banking services in Germany exceeded 15 million in 2020.

The customers of companies that offer digital banking services in Germany are mostly young people and the majority of these customers are accustomed to using digital technologies. One reason for the increasing demand for digital banking services in Germany is that they offer more affordable and flexible services than traditional banks can offer.

Most of the companies that offer digital banking services in Germany offer services to their customers via mobile applications. These apps allow customers to easily access their accounts, make money transfers and perform other financial transactions.

Many of the companies that offer digital banking services in Germany offer their customers quick and easy account opening. Account opening transactions can be made through the mobile application or the website. Also, many digital banks offer free credit cards to their customers. Many of the companies that offer digital banking services in Germany offer high interest rates to their customers. These services offer higher interest rates than traditional banks, allowing their customers to save money.

As a result, the digital banking sector in Germany is growing rapidly and many Fintech companies also offer digital banking services. The demand for digital banking services is increasing every year, offering more affordable and flexible services than traditional banks. Therefore, the digital banking sector in Germany will grow further in the future.

Share:

Related Articles

The New Direction of Capital

In recent weeks, a notable trend has emerged in global markets: a visible p ...

Turkey’s Automotive Industry: On the ...

Turkey’s automotive industry has managed to preserve its production volume ...

Healthy Growth: Why Organizations Sl ...

Companies want to grow. More market share, higher revenues, larger organiza ...

Sustainable Leadership: Power Built ...

Today, the concept of sustainability sits at the center of almost every str ...

Why Do Managers Struggle with Genera ...

A reality long felt in the business world is this: there is a natural diffe ...

Leadership

Support, love, and trust received in childhood nurture self-confidence, cou ...

Generation Z: Not Just a Mirror, but ...

One of the most frequent complaints in today’s business world is: “Young em ...

A New Era in Business with Artificia ...

The Industrial Revolution began with steam. Then came electricity, computer ...

The New Face of Entrepreneurship: Wo ...

The new generation of entrepreneurship is no longer solely profit-driven; i ...

Understood Employees Contribute and ...

In the corporate world, we often hear statements like: “They’re talented, b ...

The Silent Power of Corporate Succes ...

In today's business world, organizations operate in an environment shaped b ...

Customer Relations and Training in B ...

Bancassurance, a business model in which banks market insurance products to ...

What Awaits the Business World? A St ...

Digitalization is no longer just a technological trend but a necessity for ...

Digital Transformation in Conflict M ...

Conflict is a reality we encounter in all aspects of life. Whether at home, ...

The Road to Success: Market Dynamics ...

In today’s rapidly changing market conditions, the importance of management ...

Leadership in the Digital Age: A New ...

Leadership in the digital age requires embracing continuous learning, innov ...

Mastering Risk Management

Mastering risk management is not merely an option for businesses but a nece ...

International Banking in Germany: A ...

Germany, with its strong industrial structure, high-technology products, an ...

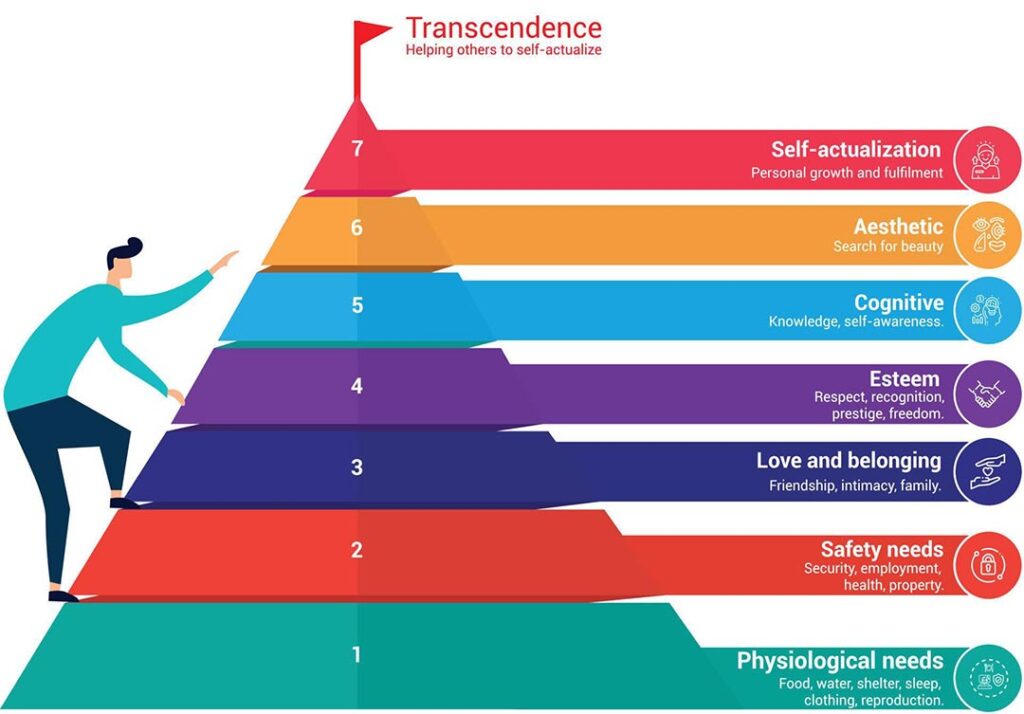

Leadership and Maslow's Hierarchy of ...

Abraham Maslow's hierarchy of needs is a fundamental psychological theory u ...

Leadership and Sustainability of Org ...

Today's business world is characterized by continuous change, technological ...

The Importance of Coaching Skills f ...

The Importance of Coaching Skills for LeadersCoaching skills are essenti ...

Fintech in Turkey: The Rise of Finan ...

Fintech in Turkey: The Rise of Financial Technology

Bancassurance

Bancassurance is a business model that is among the financial services offe ...

Banking and Frankfurt

When the banking and finance sector in Europe is analyzed, it is seen that ...

Digital Banking and Germany

Digital banking is a banking service where customers can do their banking o ...

Banking in Germany

Euro used since 2002 in The Eurozone, the currency of 19 EU members. There ...

Strategic Communication

Strategic communication plays a critical role in the success of an organiza ...

Importance of Supply Chain

The supply chain is a critical factor in which a company manages the flow o ...

Key to Success: Going Digital

Digital transformation is a transformation process that aims to increase th ...

Welfare

Poverty and inequality are one of the biggest challenges the current societ ...

ChatGPT

ChatGPT, developed by the OpenAI company known for its work and research in ...

What is Emotional Intelligence and w ...

Emotional intelligence (also known as emotional quotient or EQ) is the abil ...

The Importance of Women's Employment ...

Women's participation in the workforce is closely related to the level of d ...

Digital Banking II – Digital Banking ...

A serious step taken for the spread of “digital banking” in Turkey, providi ...

The Perception of Morality within Ma ...

If everybody in the world jumped out of a window, would you? This question ...

Digital Banking

Digital banking is a banking technology that offers customers the opportuni ...

Banking, Artificial Intelligence and ...

We have heard the concepts of metaverse, artificial intelligence and machin ...

Green Asset Ratio

Sustainable finance has an important place among the investments made for t ...

Servant Leadership

There is an effective form of management that we often hear about today: se ...

Sustainability In The Global Banking ...

Before Covid-19 wreaked havoc on the world’s economies, the global banking ...

Revolution of Digital Banking

With the European Central Bank considering to investigate for a digital cur ...

Taking Action and Making Decisions i ...

Uncertainty is the fact that an event is not within the framework of certai ...

Wind of Change

Change is an important concept that must be managed for employees at all le ...

Organizational Justice

“What is justice? Giving water to trees. What is injustice? To give water t ...

Open Banking

Digital transformation has started to show its effects in every aspect of o ...

Digital Literacy And Corporate Life

There are many innovations that managers and employees need to follow in or ...

Financial Literacy

The words money and economy are two important concepts that have a great pl ...

Sustainability and Bank

The solutions we have found to our various needs throughout history and ada ...

Adaptability, Flexibility and Leader ...

Being able to adapt to changing conditions is very, very important not only ...

Creativity and Leadership Relationsh ...

The world is getting more competitive every day. For this reason, the servi ...

Competitive Analysis and Banking Sec ...

Competition analysis requires you to examine your direct and indirect compe ...

Delegation in Management

The statements "two heads are better than one" or "teamwork makes the dream ...

Climate Change

All creatures evolve to best adapt to environmental impacts. Those who are ...

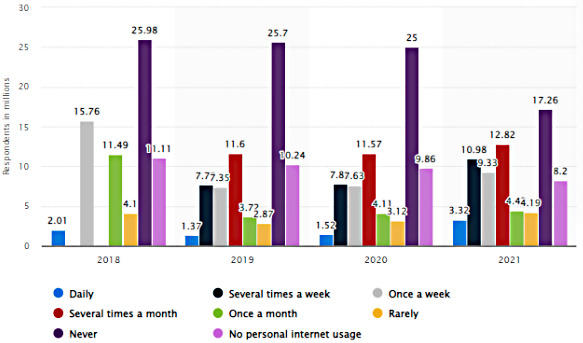

Change of Banking Service Channels i ...

Global crises such as the pandemic, force the existing structures to change ...

Innovation

It is undeniable that innovation has a very important place in today's worl ...

Artificial Intelligence

Artificial intelligence is no longer just something specific to science fic ...

Entrepreneurship

Entrepreneurship is the process of starting a new business that incorporate ...

Global Leadership

The world is changing day by day and the information we have today is out o ...

Resilience and Leadership

We encounter many events in life that cause us difficulties and stress. How ...

Entrepreneurial Spirit for Leaders

Why is important for success? The conventional perception of entrepreneursh ...

Finance Leadership in a Pandemic

Crises bring along a period in which institutions need to review their fina ...

Crisis Management

Crisis is a state of tension that puts the existence and goals of an organi ...

Strategic Leadership and Pandemic

Strategic Leader is the person who sets the roadmap to achieve the ultimate ...

Awareness, Appreciation, Success

It is very important for a person to recognize himself, discover his power ...

Woman and Career

People who are raised by unemployed mothers have a mother model in their mi ...

Conflict Management

In the broadest sense, conflict is disagreement between two or more people ...

Leading with Kindness

Kindness is an important virtue. Kindness in all areas of life makes relati ...

Smart Meetings

Meeting management is the process of managing all stages and components of ...

Negotiation Management

Negotiation is defined as a dialogue aimed at reaching a common and benefic ...

Virtual Leadership

The repercussions of the digitalization process in business life were sprea ...

Manager and Patience

Patience is an important concept in management. Patience is active, not pas ...

Being All Ears

Human beings differ from other creatures in their way of communicating. Com ...

Networking

The fact that managers in the corporate world act with awareness of network ...

Asking Strong Questions

For managers, asking a strong question is an important skill. Managers, who ...

Managing Yourself

The manager at work is in communication with the other parts of the busines ...

Mental Immunity

In the fight against Coronavirus (Covid-19) pandemic, knowledge and awarene ...