Competition analysis requires you to examine your direct and indirect competitors, their products, product development strategies, marketing strategies, sales tactics, in short, the main activities of your competitors in the market.

Competition analysis is similar to competitor analysis in that it aims to identify the strengths and weaknesses of your competitors while examining your competitors on the basis of work, method, capacity, product or service. However, the main point that distinguishes competition analysis from competitor analysis is that your company is also on the table. The main purpose is to compare your company with your competitors and measure your competitiveness.

A sector-based competition analysis examines the competitive structure in the sector from a broad perspective, including the balance of power among competitors, suppliers, customers and associated sector representatives. This analysis strategy, known as “Porter's Five Forces”, enables us to measure the impact of all stakeholders on the industry and the depth of competition. Each sector has its own dynamics, so a separate strategy for competition analysis is needed for each sector.

In the arena where competition actually takes place, drawing industry boundaries correctly will clarify the reasons for profitability and the points we need to pay attention to in order to determine a strategy. Undoubtedly, the banking and finance sector makes it necessary to create a strategy with a method different from the classical competitor and competition analysis, presented to each sector with the same prescription.

In an analysis based on competitive strategy, it is aimed to create a competitive advantage against existing or potential competitors. At this point, companies should determine the analysis perspective needed. Is it a sectoral analysis that is needed? Or is it necessary to focus on one or more competitors and make an inter-firm competitive analysis at the micro level?

What competitive analysis will bring you is not just a numerical report consisting of current figures and graphics, but also gathering the necessary intelligence from your own garden to the competitor field in order to develop your market opening strategy. On the other hand, competition by its very nature creates a competitive atmosphere and a winning motive, in short, it can increase motivation. Whether it is a macro on an industry basis or a micro competitive analysis between firms, the competitive atmosphere can increase productivity and performance.

The data you get from competitive analysis allows you to see the strengths and weaknesses of your company and your competitors. This provides the opportunity to measure the performance of company employees, managers and departments by comparing them with sectoral criteria and data obtained from your competitors thanks to an internal analysis and comparison of data.

The effect of competitive analysis on business and company performance depends on your ability to interpret the analysis results correctly and to identify the factors that affect your success chart. Performance is an important criterion for organizational results and success. Sometimes it is human resources that need to be invested, sometimes equipment or software, sometimes the company's management style or competitive strategies.

Competitive analysis has a strategic importance in how you should fight your competitors. A successful analysis sometimes leads you to identify opportunities for cooperation rather than struggle. In the business world, it has been observed that competing companies that have struggled for years form an alliance against a third competitor, and sometimes even a competitor who has just entered the market. The analysis of competitiveness gives you a roadmap for who to ally with, to increase the dosage of competition with whom.

Another feature of the competition analysis is that it provides a projection of new entrants in the sector that may compete with you in the future. All of the company acquisitions, alliances and partnerships we have witnessed in sectors such as IT, finance and banking are realized as a result of rigorous competitor and competition analysis.

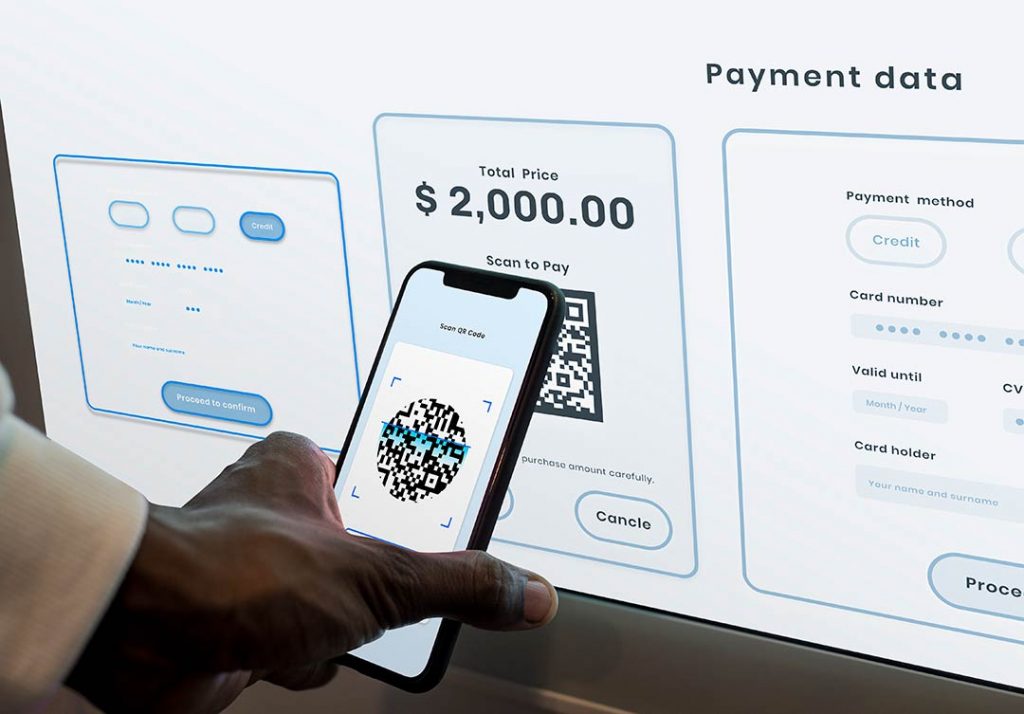

The banking industry is a challenging scene where many actors marketing similar products and services struggle. This intense competition has been adorning the screens in recent years with retail banking advertisements based on mobile and internet banking and highlighting easy and fast banking. Investments in digital banking and artificial intelligence shape the preferences of customers by offering more effective solutions for both commercial and retail banking. All of these are different from the marketing strategies of classical banking that emphasize economic benefits such as the lowest commission, the lowest interest loan and the most suitable payment options.

This pace of change based on innovation has also changed the expectations of how a bank will be managed, and bank managers' infrastructure and visions. A bank manager is now evaluated with technology literacy as much as his banking knowledge and experience. The change experienced in the past decades now fits within a few months of the calendar. Therefore, competitor and competition analyzes should be made in much faster periods, and managers who will evaluate these analysis reports should be able to create strategies in a much shorter time.

What happens when you better understand the possible steps your competitors will take, their options and, most importantly, the methods of evaluating those options, that is, how they determine their strategies? Let's give an example from the banking sector. You have studied the financial instruments of your competitor that you put on the table for competitive analysis, determined their weaknesses and strengths, and have detailed data about their suppliers and customers. But the most difficult and decisive thing is to anticipate how managers make decisions, how they formulate strategies, and unraveling your opponent's think tank.

The banking sector consists of retail banking, corporate and investment banking and asset and wealth management companies that will require the adoption of different strategies in terms of customer portfolio, structuring and management. Until a few years ago, a bank's competitor was another bank that marketed similar products and services. However, the actors are changing now.

Google has taken one more step for Google Wallet, which it has made available in digital environment, and work is underway for 'Google Card'. In addition to advanced usage options such as Face ID, Touch ID and Apple Pay, the 'Apple Card' offered by Apple in partnership with 'Goldman Sachs' is currently used as a physical credit card. Chinese technology giant Huawei offers banking services with 'Huawei Card'. After proposing dematerialized payment solutions, many manufacturers are entering the banking industry with real physical cards.

In short, the solutions offered by sectoral competition analysis are especially changing the sector, and in-depth competition analysis of competitors who are new to the banking sector is of vital importance for the financial world, especially for banks. Possible competitors are more dangerous than current competitors, because each comes based on different services and products, that is, focusing on different segments of the pie, adapting their technological know-how to banking services.

Banks have a long history in the real market, and the competition between them continues fiercely. But banks also have advantages in the digital world, with years of investment in technology, broad customer bases, payment security, and the various financial instruments they offer to customers. Competitive analysis is the most important weapon against interbank and newcomers to the banking sector. Banks will decide on partnerships, mergers or their selectivity in competition, the instruments and budgets they will use for competition, with the strategies they will develop through competition analysis.

References:

By Hugh Courtney and John T. Horn, and Jayanti Kar (2009),” Getting into your competitor’s head”, McKinsey Insights,

https://www.mckinsey.com/business-functions/strategy-and-corporate-finance/our-insights/getting-into-your-competitors-head

Michael E. Porter, (2008) “The Five Competitive Forces That Shape Strategy” Harvard Business Review,

https://hbr.org/2008/01/the-five-competitive-forces-that-shape-strategy

Wayne Busch and Juan Pedro Moreno (2014) “Banks’ New Competitors: Starbucks, Google, and Alibaba” Harvard Business Review,

https://hbr.org/2014/02/banks-new-competitors-starbucks-google-and-alibaba

Share:

Related Articles

Understood Employees Contribute and ...

In the corporate world, we often hear statements like: “They’re talented, b ...

The Silent Power of Corporate Succes ...

In today's business world, organizations operate in an environment shaped b ...

Customer Relations and Training in B ...

Bancassurance, a business model in which banks market insurance products to ...

What Awaits the Business World? A St ...

Digitalization is no longer just a technological trend but a necessity for ...

Digital Transformation in Conflict M ...

Conflict is a reality we encounter in all aspects of life. Whether at home, ...

The Road to Success: Market Dynamics ...

In today’s rapidly changing market conditions, the importance of management ...

Leadership in the Digital Age: A New ...

Leadership in the digital age requires embracing continuous learning, innov ...

Mastering Risk Management

Mastering risk management is not merely an option for businesses but a nece ...

International Banking in Germany: A ...

Germany, with its strong industrial structure, high-technology products, an ...

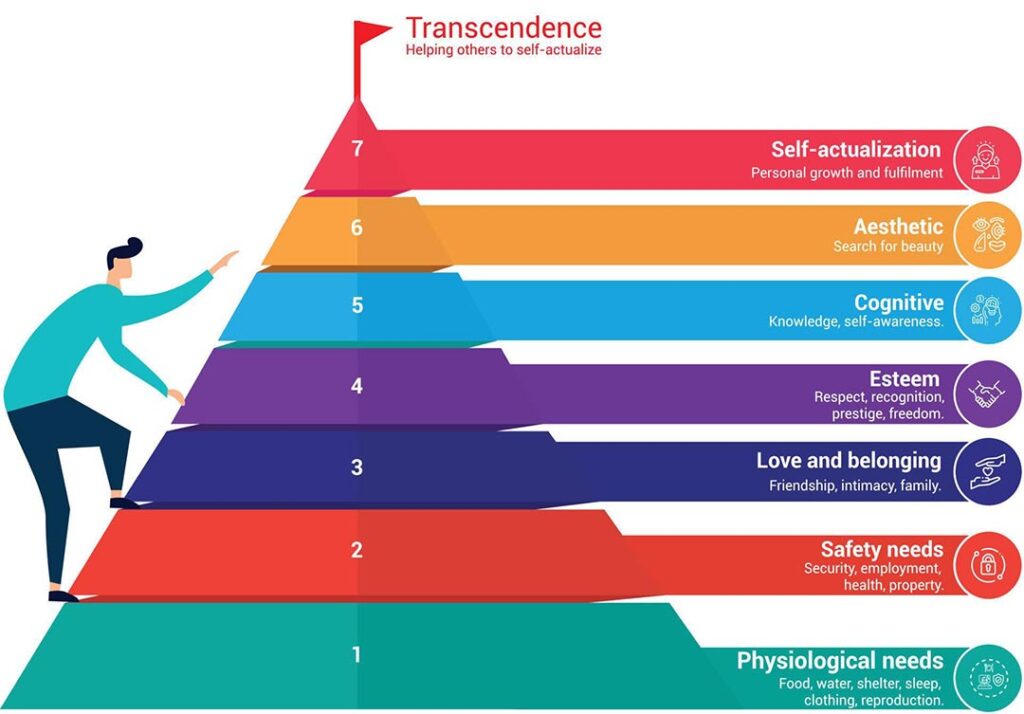

Leadership and Maslow's Hierarchy of ...

Abraham Maslow's hierarchy of needs is a fundamental psychological theory u ...

Leadership and Sustainability of Org ...

Today's business world is characterized by continuous change, technological ...

The Importance of Coaching Skills f ...

The Importance of Coaching Skills for LeadersCoaching skills are essenti ...

Fintech in Turkey: The Rise of Finan ...

Fintech in Turkey: The Rise of Financial Technology

Bancassurance

Bancassurance is a business model that is among the financial services offe ...

Banking and Frankfurt

When the banking and finance sector in Europe is analyzed, it is seen that ...

Digital Banking and Germany

Digital banking is a banking service where customers can do their banking o ...

Banking in Germany

Euro used since 2002 in The Eurozone, the currency of 19 EU members. There ...

Strategic Communication

Strategic communication plays a critical role in the success of an organiza ...

Importance of Supply Chain

The supply chain is a critical factor in which a company manages the flow o ...

Key to Success: Going Digital

Digital transformation is a transformation process that aims to increase th ...

Welfare

Poverty and inequality are one of the biggest challenges the current societ ...

ChatGPT

ChatGPT, developed by the OpenAI company known for its work and research in ...

What is Emotional Intelligence and w ...

Emotional intelligence (also known as emotional quotient or EQ) is the abil ...

The Importance of Women's Employment ...

Women's participation in the workforce is closely related to the level of d ...

Digital Banking II – Digital Banking ...

A serious step taken for the spread of “digital banking” in Turkey, providi ...

The Perception of Morality within Ma ...

If everybody in the world jumped out of a window, would you? This question ...

Digital Banking

Digital banking is a banking technology that offers customers the opportuni ...

Banking, Artificial Intelligence and ...

We have heard the concepts of metaverse, artificial intelligence and machin ...

Green Asset Ratio

Sustainable finance has an important place among the investments made for t ...

Servant Leadership

There is an effective form of management that we often hear about today: se ...

Sustainability In The Global Banking ...

Before Covid-19 wreaked havoc on the world’s economies, the global banking ...

Revolution of Digital Banking

With the European Central Bank considering to investigate for a digital cur ...

Taking Action and Making Decisions i ...

Uncertainty is the fact that an event is not within the framework of certai ...

Wind of Change

Change is an important concept that must be managed for employees at all le ...

Organizational Justice

“What is justice? Giving water to trees. What is injustice? To give water t ...

Open Banking

Digital transformation has started to show its effects in every aspect of o ...

Digital Literacy And Corporate Life

There are many innovations that managers and employees need to follow in or ...

Financial Literacy

The words money and economy are two important concepts that have a great pl ...

Sustainability and Bank

The solutions we have found to our various needs throughout history and ada ...

Adaptability, Flexibility and Leader ...

Being able to adapt to changing conditions is very, very important not only ...

Creativity and Leadership Relationsh ...

The world is getting more competitive every day. For this reason, the servi ...

Competitive Analysis and Banking Sec ...

Competition analysis requires you to examine your direct and indirect compe ...

Delegation in Management

The statements "two heads are better than one" or "teamwork makes the dream ...

Climate Change

All creatures evolve to best adapt to environmental impacts. Those who are ...

Change of Banking Service Channels i ...

Global crises such as the pandemic, force the existing structures to change ...

Innovation

It is undeniable that innovation has a very important place in today's worl ...

Artificial Intelligence

Artificial intelligence is no longer just something specific to science fic ...

Entrepreneurship

Entrepreneurship is the process of starting a new business that incorporate ...

Global Leadership

The world is changing day by day and the information we have today is out o ...

Resilience and Leadership

We encounter many events in life that cause us difficulties and stress. How ...

Entrepreneurial Spirit for Leaders

Why is important for success? The conventional perception of entrepreneursh ...

Finance Leadership in a Pandemic

Crises bring along a period in which institutions need to review their fina ...

Crisis Management

Crisis is a state of tension that puts the existence and goals of an organi ...

Strategic Leadership and Pandemic

Strategic Leader is the person who sets the roadmap to achieve the ultimate ...

Awareness, Appreciation, Success

It is very important for a person to recognize himself, discover his power ...

Woman and Career

People who are raised by unemployed mothers have a mother model in their mi ...

Conflict Management

In the broadest sense, conflict is disagreement between two or more people ...

Leading with Kindness

Kindness is an important virtue. Kindness in all areas of life makes relati ...

Smart Meetings

Meeting management is the process of managing all stages and components of ...

Negotiation Management

Negotiation is defined as a dialogue aimed at reaching a common and benefic ...

Virtual Leadership

The repercussions of the digitalization process in business life were sprea ...

Manager and Patience

Patience is an important concept in management. Patience is active, not pas ...

Being All Ears

Human beings differ from other creatures in their way of communicating. Com ...

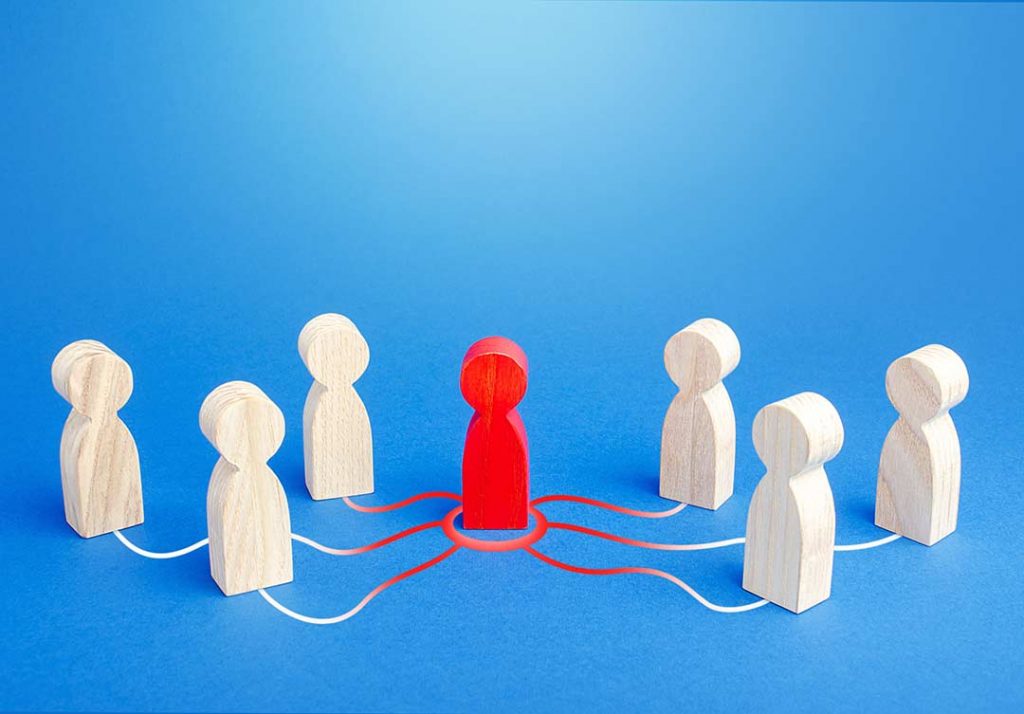

Networking

The fact that managers in the corporate world act with awareness of network ...

Asking Strong Questions

For managers, asking a strong question is an important skill. Managers, who ...

Managing Yourself

The manager at work is in communication with the other parts of the busines ...

Mental Immunity

In the fight against Coronavirus (Covid-19) pandemic, knowledge and awarene ...