gather ye rosebuds while ye may,

old time is still a-flying

and this same flower that smiles today

tomorrow will be dying.

This poem written by Robert Herrick came to life in the movie Dead Poets Society and is engraved in our memories. Although it is concluded to the carpe diem motto, there is also the dimension of living the moment keeping up with time. So, time not only changes numerically but also improves the order we are used to. Global crises such as the pandemic, force the existing structures to change irreversibly.

The history of banks goes back to before Christ. The borrowing and lending activities, which were initially made on the bench, developed banking with the development of trade. Also, the need to find reliable bankers ensured some merchants cooperate with other merchants and the first steps of the branches were taken. The Laws of Hammurabi, which are estimated to date back to the 18th century BC, include borrowing and lending, collection methods, crediting and methods of legally securing the debt. Especially with the influence of the Renaissance period, banking became more institutional and European Banks began to be established in the 17th century. With the development of the industry and entering the modern age, banking activities have accelerated. However, banks that were previously only located in the central regions started to open in the provinces as well. Of course, this is possible in favor of branching and even citizens living in the most remote corners can make their banking transactions without going to the central.

In ancient ages, banking was naturally conducted on an individual basis and generally had a local structure. Over time, the banking organization developed due to the increase in business, the emergence of some natural disasters and crises, and the need for loans to do business. In the 19th century, banking activities went beyond borrowing and lending and enabled the circulation of capital market instruments in commercial life. After the Great Depression of 1929, banking activities became more and more important. Because at that time, to recover from the damage caused by the First World War and to recover the damaged countries the stage of giving credit to them was started. Investment and development banks became widespread after other crises and especially the Second World War. Of course, banks have chosen to specialize and develop their staff to meet the increasing needs and respond to the demands in the best way. This turned the banking sector into a sector that serves almost every field of the economy. For example, according to data Banks Association of Turkey; In Turkey, there were about 6,500 bank branches in 2002, that number was closer to 9,000 in 2009, there were 11,564 in 2017, and has fallen to 9867 as of February 8, 2021.

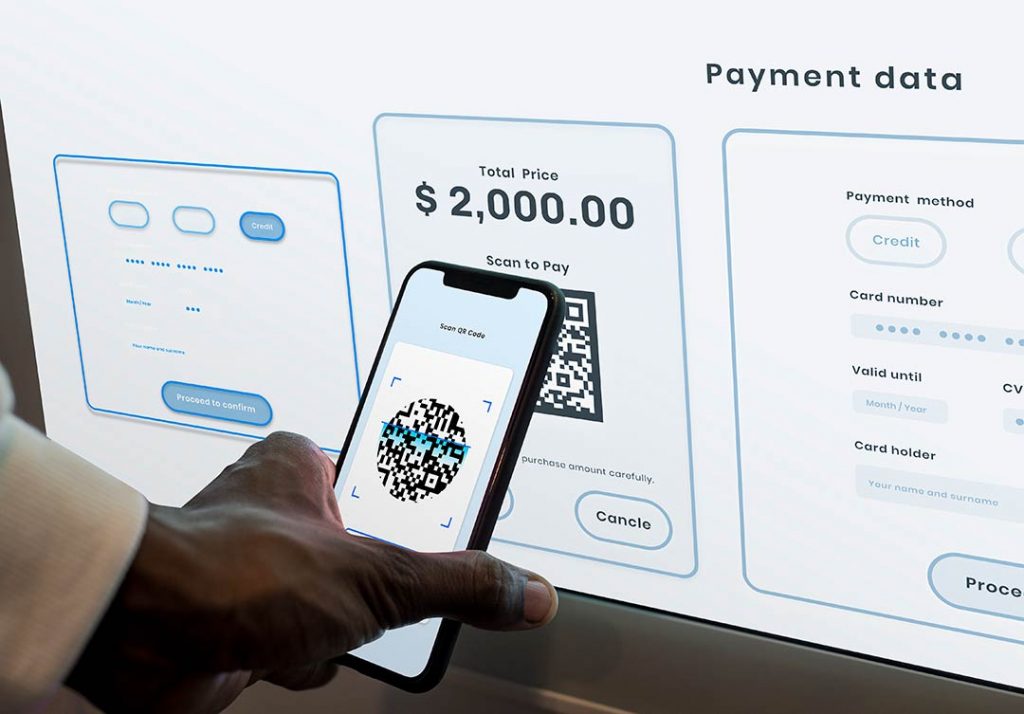

With the increase of computers and technology in our lives and especially the spread of the internet, electronic banking has become important. With electronic banking, banks' classical working hours were exceeded and customers started to be able to make transactions whenever they wanted. Of course, the spread of mobile devices has also been effective in this case. For this reason, interest in alternative distribution channels has intensified.

With the widespread use of the Internet, people are more likely to make transactions with one click without going to branches. This has ensured that the need for personnel for banking transactions is disappeared and customers can make banking transactions via their computers or mobile devices. Going out of traditional banking and making transactions in this way without going to branches are called alternative distribution channels in banking literature. In other words, this name is given to the tools that enable customers to make transactions without going to branches with the use of technology and various technological infrastructures. Alternative distribution channels include banks' call centers, ATMs, internet branches and mobile banking applications. Customers who do not have to go to branches will be able to make almost any transaction on the internet via their mobile phones or computers. For example, according to İşbank data, 61.2% of the transactions made through this bank in 2009 were realized through alternative distribution channels. This rate has increased even more in the past 10 years.

It is important for bank employees that increasing their current competencies, being flexible, knowing their resources well, investing in their development, developing themselves in technology and creativity, Also, if necessary, getting opinions from consultants will increase their belief in themself.

Due to the coronavirus affecting the whole world, bank branches shortened their normal working hours and the need for remote transactions has

increased. The main reason for this is people are not wanting to go out to be protected from the virus. For this reason, banks have focused on alternative distribution channels and most of the transactions were made through mobile banking applications and internet banking, especially during the pandemic period. One of the reasons this is effective is that banks make it possible to make almost every transaction via internet banking. For example, 99% of the transactions of Garanti Bank can be made via internet banking. Banks that were prepared for crises and foresee this and invested in alternative distribution channels were able to manage customer needs well during the pandemic period. So, during this period, the use of alternative distribution channels has increased by 20-30%.

With the development of technology and investment in innovation, alternative distribution channels have come to the forefront more. On the other hand, this development changes the classical banking idea. According to Deloitte's survey, customers like branches more. One of the main reasons for this is the complexity of the interfaces and the opportunity to communicate face to face. However, this problem is a fact that can be overcome with artificial intelligence and innovation. Also, increasing technological literacy will change this approach of customers.

Time is flowing like water. Today's technology will not exist tomorrow. These changes are affecting organizations, employees and ways of doing business. The necessity to analyze these changes well and resilience is an important issue for both individuals and organizations.

Share:

Related Articles

What Awaits the Business World? A St ...

Digitalization is no longer just a technological trend but a necessity for ...

Digital Transformation in Conflict M ...

Conflict is a reality we encounter in all aspects of life. Whether at home, ...

The Road to Success: Market Dynamics ...

In today’s rapidly changing market conditions, the importance of management ...

Leadership in the Digital Age: A New ...

Leadership in the digital age requires embracing continuous learning, innov ...

Mastering Risk Management

Mastering risk management is not merely an option for businesses but a nece ...

International Banking in Germany: A ...

Germany, with its strong industrial structure, high-technology products, an ...

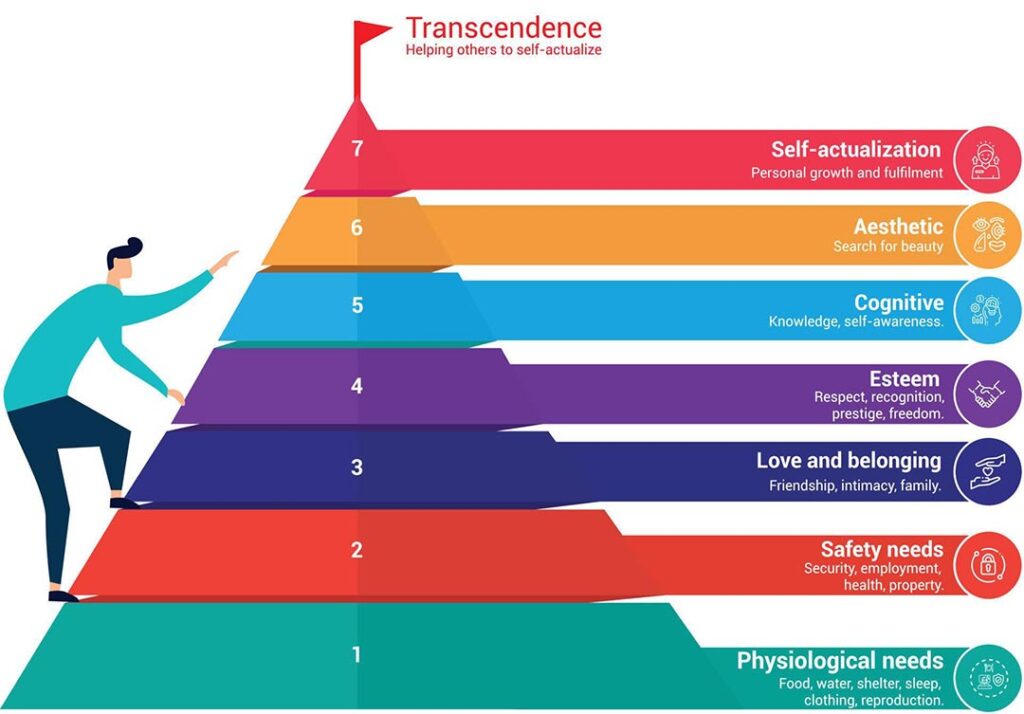

Leadership and Maslow's Hierarchy of ...

Abraham Maslow's hierarchy of needs is a fundamental psychological theory u ...

Leadership and Sustainability of Org ...

Today's business world is characterized by continuous change, technological ...

The Importance of Coaching Skills f ...

The Importance of Coaching Skills for LeadersCoaching skills are essenti ...

Fintech in Turkey: The Rise of Finan ...

Fintech in Turkey: The Rise of Financial Technology

Bancassurance

Bancassurance is a business model that is among the financial services offe ...

Banking and Frankfurt

When the banking and finance sector in Europe is analyzed, it is seen that ...

Digital Banking and Germany

Digital banking is a banking service where customers can do their banking o ...

Banking in Germany

Euro used since 2002 in The Eurozone, the currency of 19 EU members. There ...

Strategic Communication

Strategic communication plays a critical role in the success of an organiza ...

Importance of Supply Chain

The supply chain is a critical factor in which a company manages the flow o ...

Key to Success: Going Digital

Digital transformation is a transformation process that aims to increase th ...

Welfare

Poverty and inequality are one of the biggest challenges the current societ ...

ChatGPT

ChatGPT, developed by the OpenAI company known for its work and research in ...

What is Emotional Intelligence and w ...

Emotional intelligence (also known as emotional quotient or EQ) is the abil ...

The Importance of Women's Employment ...

Women's participation in the workforce is closely related to the level of d ...

Digital Banking II – Digital Banking ...

A serious step taken for the spread of “digital banking” in Turkey, providi ...

The Perception of Morality within Ma ...

If everybody in the world jumped out of a window, would you? This question ...

Digital Banking

Digital banking is a banking technology that offers customers the opportuni ...

Banking, Artificial Intelligence and ...

We have heard the concepts of metaverse, artificial intelligence and machin ...

Green Asset Ratio

Sustainable finance has an important place among the investments made for t ...

Servant Leadership

There is an effective form of management that we often hear about today: se ...

Sustainability In The Global Banking ...

Before Covid-19 wreaked havoc on the world’s economies, the global banking ...

Revolution of Digital Banking

With the European Central Bank considering to investigate for a digital cur ...

Taking Action and Making Decisions i ...

Uncertainty is the fact that an event is not within the framework of certai ...

Wind of Change

Change is an important concept that must be managed for employees at all le ...

Organizational Justice

“What is justice? Giving water to trees. What is injustice? To give water t ...

Open Banking

Digital transformation has started to show its effects in every aspect of o ...

Digital Literacy And Corporate Life

There are many innovations that managers and employees need to follow in or ...

Financial Literacy

The words money and economy are two important concepts that have a great pl ...

Sustainability and Bank

The solutions we have found to our various needs throughout history and ada ...

Adaptability, Flexibility and Leader ...

Being able to adapt to changing conditions is very, very important not only ...

Creativity and Leadership Relationsh ...

The world is getting more competitive every day. For this reason, the servi ...

Competitive Analysis and Banking Sec ...

Competition analysis requires you to examine your direct and indirect compe ...

Delegation in Management

The statements "two heads are better than one" or "teamwork makes the dream ...

Climate Change

All creatures evolve to best adapt to environmental impacts. Those who are ...

Change of Banking Service Channels i ...

Global crises such as the pandemic, force the existing structures to change ...

Innovation

It is undeniable that innovation has a very important place in today's worl ...

Artificial Intelligence

Artificial intelligence is no longer just something specific to science fic ...

Entrepreneurship

Entrepreneurship is the process of starting a new business that incorporate ...

Global Leadership

The world is changing day by day and the information we have today is out o ...

Resilience and Leadership

We encounter many events in life that cause us difficulties and stress. How ...

Entrepreneurial Spirit for Leaders

Why is important for success? The conventional perception of entrepreneursh ...

Finance Leadership in a Pandemic

Crises bring along a period in which institutions need to review their fina ...

Crisis Management

Crisis is a state of tension that puts the existence and goals of an organi ...

Strategic Leadership and Pandemic

Strategic Leader is the person who sets the roadmap to achieve the ultimate ...

Awareness, Appreciation, Success

It is very important for a person to recognize himself, discover his power ...

Woman and Career

People who are raised by unemployed mothers have a mother model in their mi ...

Conflict Management

In the broadest sense, conflict is disagreement between two or more people ...

Leading with Kindness

Kindness is an important virtue. Kindness in all areas of life makes relati ...

Smart Meetings

Meeting management is the process of managing all stages and components of ...

Negotiation Management

Negotiation is defined as a dialogue aimed at reaching a common and benefic ...

Virtual Leadership

The repercussions of the digitalization process in business life were sprea ...

Manager and Patience

Patience is an important concept in management. Patience is active, not pas ...

Being All Ears

Human beings differ from other creatures in their way of communicating. Com ...

Networking

The fact that managers in the corporate world act with awareness of network ...

Asking Strong Questions

For managers, asking a strong question is an important skill. Managers, who ...

Managing Yourself

The manager at work is in communication with the other parts of the busines ...

Mental Immunity

In the fight against Coronavirus (Covid-19) pandemic, knowledge and awarene ...